The Magnificent 7

Issue #150

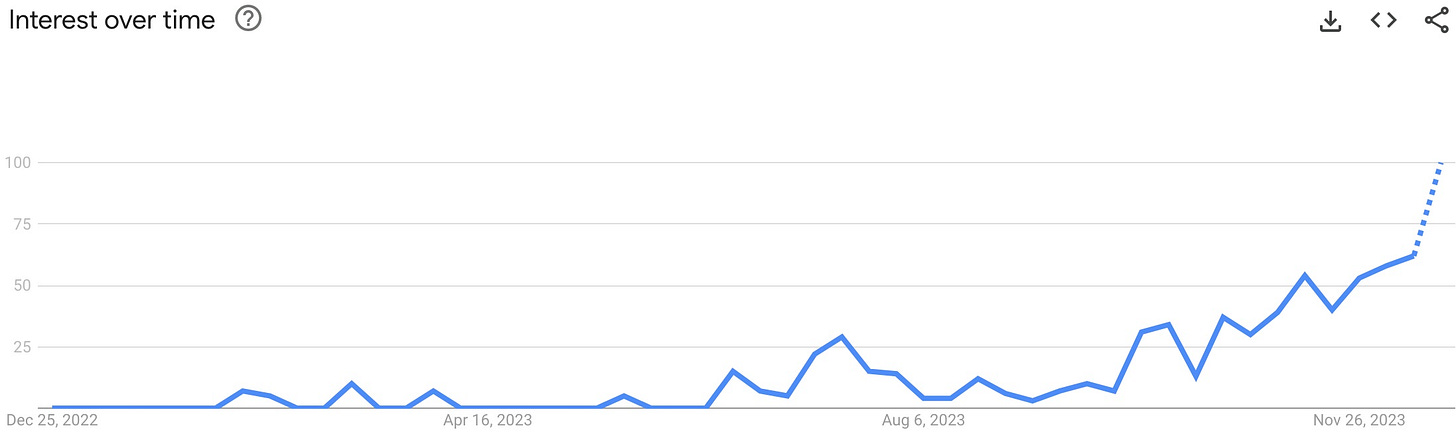

Whenever you hear about a small group of stocks that have performed so well in the last year or so that they've been given their own nickname (e.g., Nifty Fifty, BRICs, FAANG, etc.), watch out. Whenever I hear about such constructs, my contrarian antennae perk up. The latest such group is called the Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla). Here's a chart from Google Trends of searches for “Magnificent 7 stocks.”

Why do you hear about such stocks? Because the media reports on their high returns, which draws in more Dumb Money. As their market capitalization increases, market cap-weighted funds—which comprise most investment products today—have to buy more. This is a Doomsday machine.

Why do investors (especially Americans) buy such stocks? Because they want to get rich quick. They want something for nothing. Recency Bias tricks their brain into believing that the high returns will continue indefinitely. The financial media tells stories that provide justification for the buy decision. Of course, no fundamental analysis is needed, and besides, that would require knowledge, information, time and energy. Just do what everyone else is doing, and we'll all get rich together. How could the masses be wrong?

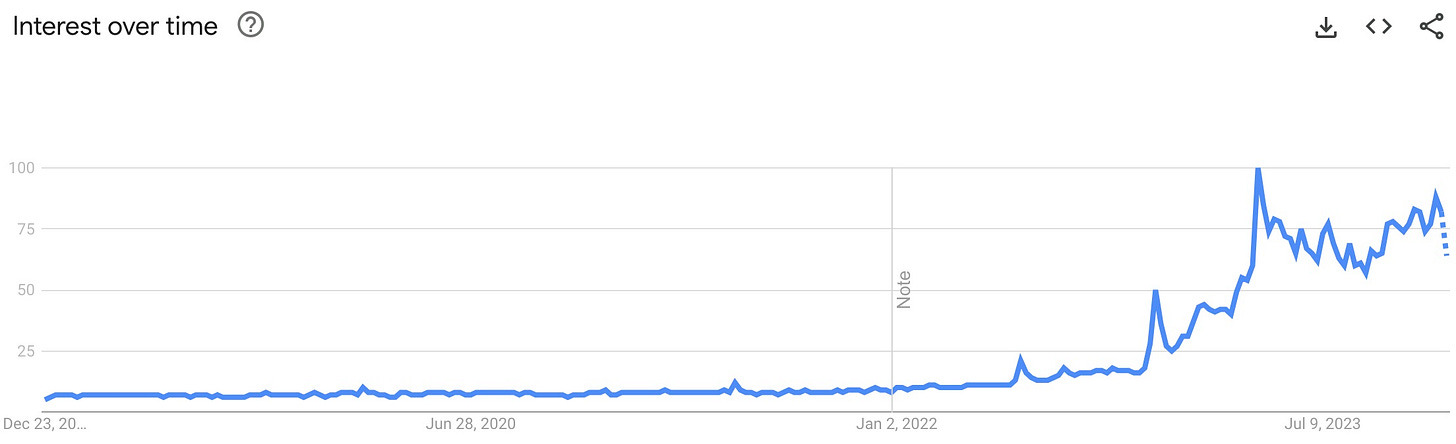

The story du jour is artificial intelligence. Supposedly, nearly all of the Magnificent 7 stand to make a fortune from AI. According to Brave AI, “The Magnificent Seven stocks are among the best stocks to buy and watch in the market today.” Oh! So basically, a machine is recommending that investors buy the companies that make the machine. That's some nice recursion.

I think we've reached Peak AI (see the chart from Google Trends below), which has been everywhere. It's on the cover of a magazine I received recently (magazines are famous for doing a cover story on a subject just before the tide turns). I've even seen investment advisors who use AI to make investment recommendations and manage portfolios! A couple of years from now after this bubble has popped, they'll say in their defense, “I was just following the machine's orders!”

Every so often a new technology comes along that revolutionizes some aspect of human affairs. Invariably, investors believe they can make a fortune by investing in the companies that are involved with the new technology. Sure, a few of the early companies make some money. But then the stories attract hordes of eager investors, which in turn attracts lots of competing companies, and then promoters, and finally fraudsters. The technology does prove to be revolutionary, but in the end, investors generally don't make any money from it due to too much competition and overpaying for stocks.

Ever heard of the British Bicycle Mania? I hadn't, either, until I started reading Boom and Bust: A Global History of Financial Bubbles. In the late 1800s, the invention of a bicycle that was easy to ride promised to transform society. Investors piled into the story, and hundreds of bicycle companies sprang up in the UK alone. There was a boom and then a bust. That technology is still in use today, but no investors were able to earn abnormally high returns for a prolonged period of time. In fact, the average investor probably lost money.

Buying story stocks is easy: recent returns have been very high, everyone is talking about it, and you can even brag about owning them at social events. If you're a single guy at a party, which line do you think would make you more attractive to a potential mate? “I invest in AI companies” or “I own stock in Hormel, which makes Spam”? Hormel has actually been a terrific stock to own over the long term, generally churning out increasing dividends for nearly two decades (though it's not attractive currently due to excessive short interest).

I'm not a fan of Warren Buffett, but I agree with him when he said that “Investing should be like watching paint dry.” The irony of investing is you don't need to buy into a story to have a good experience; in fact, the more you ignore stories, the better off you'll be.

If you want to earn high returns, you have to be a contrarian and do the opposite of what everyone else is doing. You have to take the hard, scary, lonely trades. You have to buy what no one else wants and sell what everyone wants. You have to go against the crowd, which is very difficult for the human brain to do because for millennia, it generally paid for humans to mimic what everyone else in their tribe was doing. If you saw everyone running, it was because danger was near. If you didn't run as well, your genes probably wouldn't get passed on.

OK, so since few investors have the knowledge, time, etc. to do any fundamental analysis of the Magnificent 7—they just passively allow their index fund to buy more shares of them—let's take a closer look at these stocks. These are just the highlights, not a deep dive.

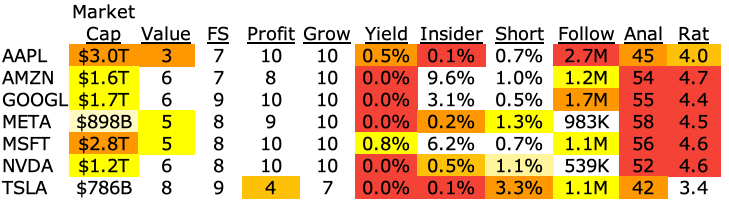

I've summarized many fundamental ratios in four areas (value, financial strength [FS], profitability and growth) into just a single number to keep it simple, with 10 being best. “Insider” is the percentage of shares that company insiders own. “Short” is the percentage of shares that short sellers (generally, Smart Money) have sold short. “Follow” is the number of people who follow the stock on a website that's popular with fairly serious investors. “Anal” is the number of Wall Street analysts who cover and rate the stock. And “Rat” is the average analyst rating for the stock, with 5.0 being a Strong Buy and 1.0 being a Strong Sell.

The first thing to note about these stocks is that currently, they comprise 28.2% of the S&P 500 index. So the average investor has massive exposure to these stocks. What could go wrong?

Next, take a look at the market caps. Apple weighs in at $3 trillion! It just breached the $1 trillion mark (a record) in mid-2018. Microsoft is at $2.8 trillion, and five of the seven are over $1 trillion. Yes, the growth of these companies has been great, but since we live in a finite world, it can't continue forever.

Tesla is the only stock that could be considered value-priced, but its profitability is unimpressive. The only thing keeping it alive are the massive payments that makers of non-electric cars have to give it.

Five of the seven stocks pay no (or virtually no) dividend, and the yield of the other two is 0.8% or less. The dividend yield of the stocks that pay a dividend is at at historic low, which is a warning sign. If the story falls apart, there would be few if any dividends to support the value of the Mag 7.

Four of the seven stocks have very low insider ownership, and short sellers have sold short significantly more shares of all four. Insider ownership at Amazon, Microsoft, and Alphabet, however, is very impressive, and short sellers have kept away from those stocks.

The number of investors who follow these stocks (especially Apple) is concerning. This is a very crowded trade.

Five of the seven stocks are covered by at least 52 Wall Street analysts, which is extremely high. And the average rating on five of the seven is closer to a Strong Buy, which is even more alarming. You see, generally, Wall Street analysts are wrong. I don't think they're incompetent, you just have to look at who employs them and why.

Wall Street banks make money primarily by helping corporations raise capital from investors, and by getting their brokerage customers to trade. It's rare to see a Sell rating from an analyst because the investment bank doesn't want to risk losing a corporation's business (which also includes managing and/or providing ETFs or mutual funds for the company's 401(k) plan). The purpose of analysts is not to provide good investment advice to their brokerage customers, but to maintain a good relationship with corporate executives and to tell stories to their brokerage customers to prompt them to trade.

At the long end of a bull market, the dumbest of the Dumb Money (small, unknowledgeable, inexperienced investors) gets sucked into the game. They buy the largest, most well-known companies that have performed well in the recent past that everyone is talking about. Sooner rather than later, there's no one left to buy, and prices begin a long slide.

A year or two from now, they'll be so disgusted with their losses that they won't even bother to open their monthly brokerage statements. No one will be talking about The Story anymore. The new technology will change society, but few people will have made abnormal profits from it, because there was too much hype and competition. Investors will realize they've been sold a bill of goods and will be left holding the bag.

And when no one seems interested in the fishing hole anymore, that will be the time to go fishing for your own Lowly 7.

Recommended Books (I receive a commission if you buy a book via this link.)

I would love to hear from you! If you have any comments, suggestions, insight/wisdom, or you'd like to share a great article, please leave a comment.

Disclaimer

The content of this newsletter is intended to be and should be used for informational/ educational purposes only. You should not assume that it is accurate or that following my recommendations will produce a positive result for you. You should either do your own research and analysis, or hire a qualified professional who is aware of the facts and circumstances of your individual situation.

Financial Preparedness LLC is not a registered investment advisor. I am not an attorney, accountant, doctor, nutritionist or psychologist. I am not YOUR financial planner or investment advisor, and you are not my client.

Investments carry risk, are not guaranteed, and do fluctuate in value, and you can lose your entire investment. Past performance is not indicative of future performance. You should not invest in something you don't understand, or put all of your eggs in one basket.

Before starting a new diet or exercise regimen, you should consult with a doctor, nutritionist, dietician, or personal trainer.