Issue #137

For decades now, I have been warning that a massive federal debt crisis was coming. In recent years, I predicted that as soon as interest rates started to rise (from their artificially low level, thanks to the Fed), we would pass the event horizon of this debt black hole, making escape impossible. If only the situation was that benign. You see, not only has the federal debt crisis arrived, it will also be accompanied by a debt crisis at every other level of society: consumer, corporate, state and local government, and (foreign) sovereign.

This will lead to hyperinflation, which will precipitate the largest fiscal, economic and financial crisis in human history, resulting in monumental political and geopolitical changes. It will cause history to leap.

A few days ago, federal debt surpassed $33 trillion, up an impressive $1 trillion just in the past three months (and up $56 billion in one day). I remember reading an article in the Wall Street Journal around 1995 titled “How Much Is a Trillion Dollars?” when the entire federal budget first surpassed $1 trillion. One of the examples they gave was a long train of boxcars full of $1 bills stretching from Washington D.C. to New York City (or something like that).

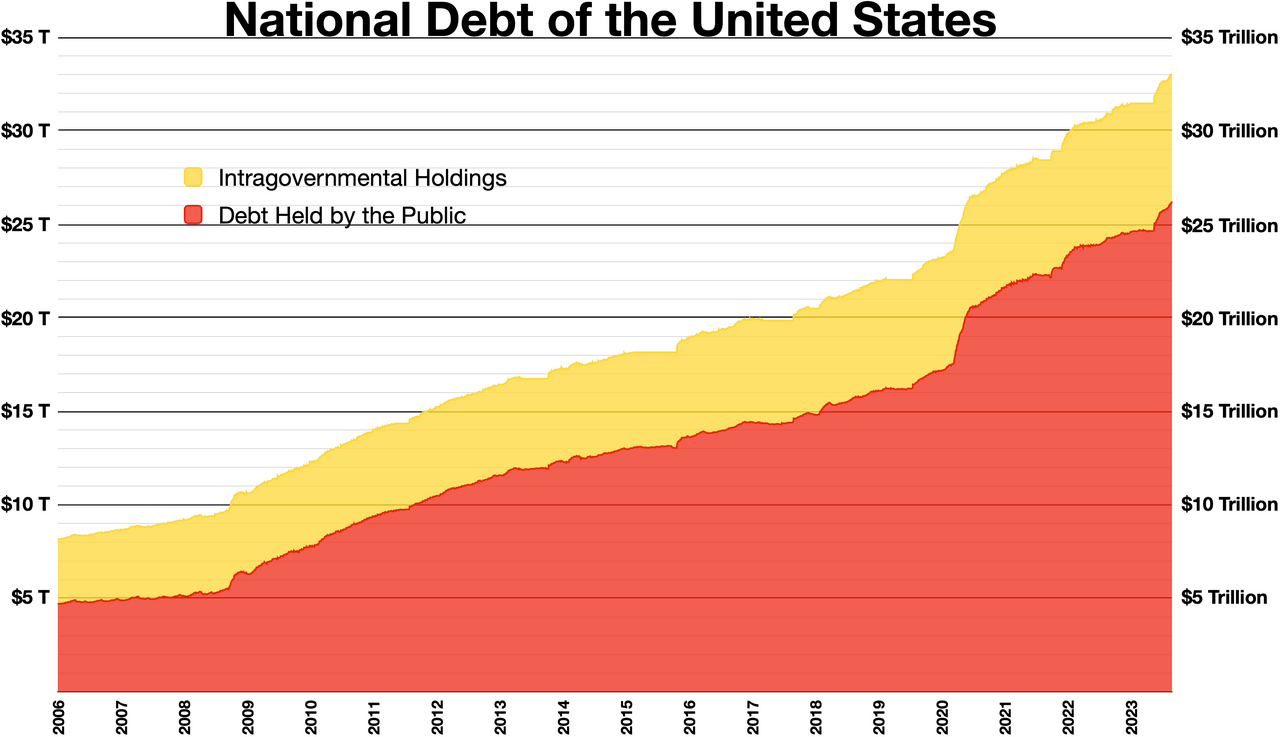

Let's look at some charts. Since 2006, the national debt has soared from about $8 trillion to over $33 trillion.

Since 1966, the federal debt/revenue ratio has soared from about 2.25 to about 6.75.

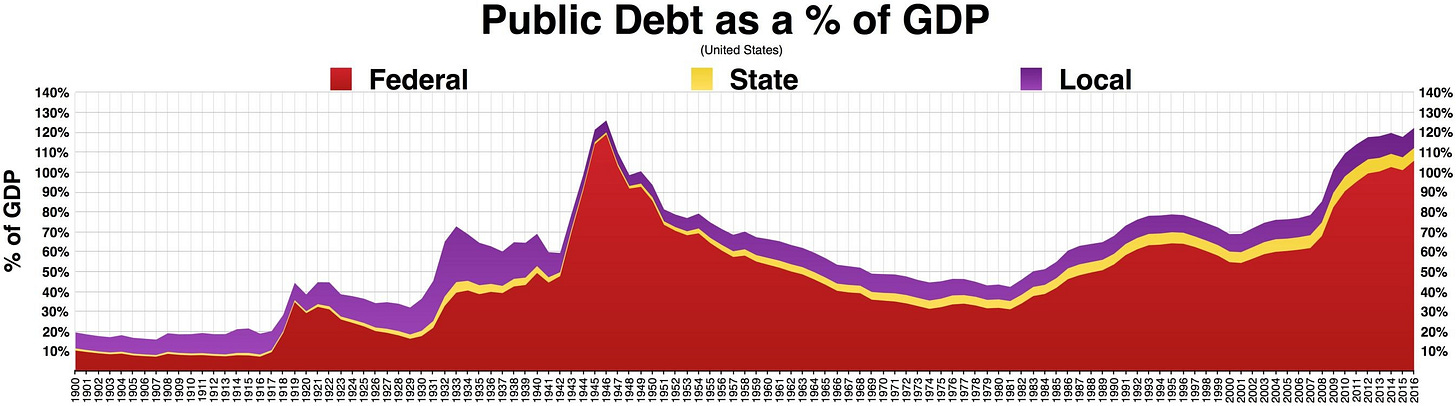

During the same time, the total government debt/GDP ratio increased from about 50% to about 135%.

Here's a longer term chart that goes from 1900 (when total government debt was less than 20% of GDP) to 2016:

This chart (from 2001 to 2016) shows that deficits and debt began to pile on with the government bailouts during the Great Financial Crisis of 2008:

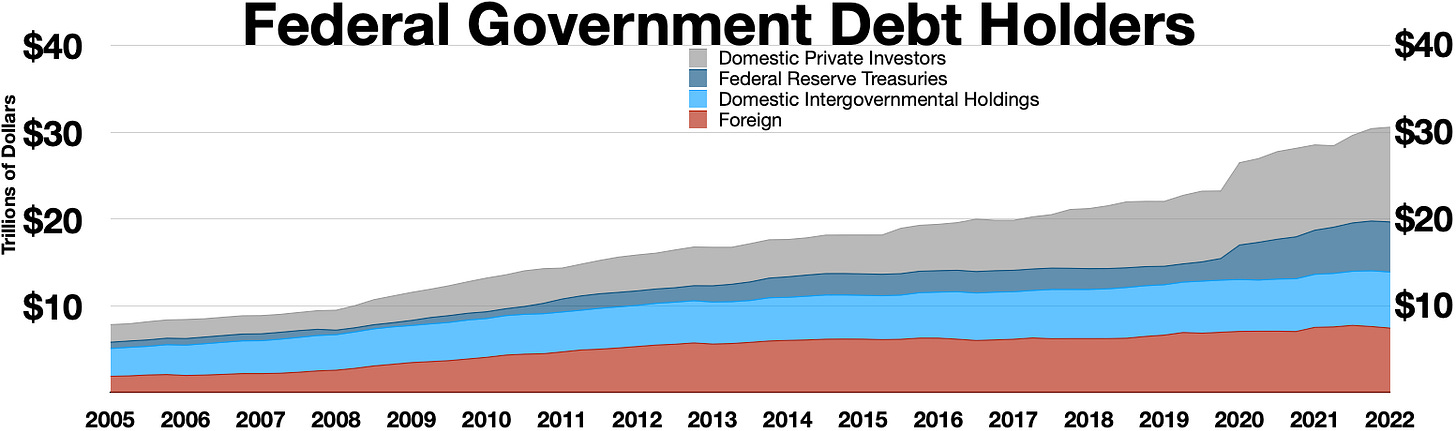

The next chart shows who has owned how much federal debt since 2005. “Domestic Intergovernmental Holdings” is federal debt owned by various federal entities such as the Social Security Trust Fund and the military and civil service pension systems. So when those entities need cash to pay benefits in the future, they will have to sell the Treasuries they own, which will depress the price of other Treasury securities and increase all interest rates. Note how federal debt held by the Fed has gone from a small amount in 2008 to roughly $5 trillion in 2022. “Domestic Private Investors” includes banks, which we will discuss further below.

Let's zoom in on the first slice of the chart above and look at foreign owners by country. China is no longer the largest owner, Japan is.

The relative percentage of Treasuries owned by foreign central banks has declined by more than half since around 2011 (see the chart at the bottom of page 7 and the chart at the bottom of page 10).

The next table shows that during the last year, the two countries that own the most Treasuries have slashed their holdings by at least 10%. One wonders why and how the tiny Cayman Islands owns so much.

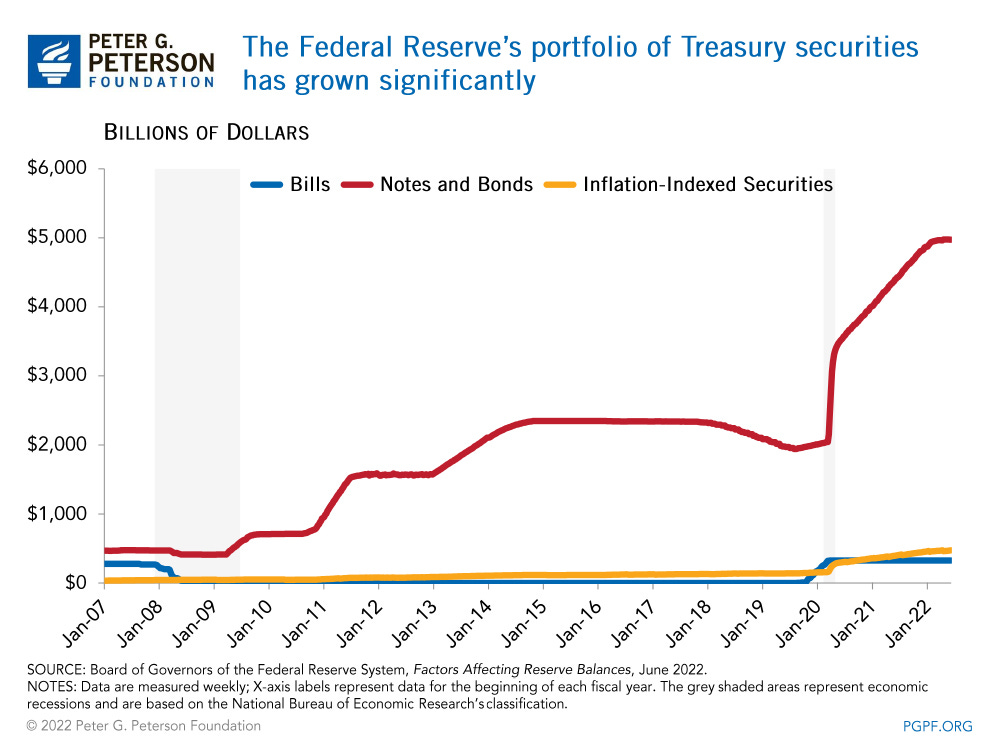

Now let's take a closer look at how the Fed's Treasury holdings have changed. This chart shows that the Fed's holdings increased from $533 billion in 2001 to $6 trillion in 2022. In other words, the percentage of federal debt owned by the Fed increased from 9.3% to 19.7%. The Fed has been the great enabler of deficit spending.

The next chart shows how the Fed has been bailing out the federal government since COVID by buying up short-term Treasury bills (original maturity of 4 weeks to one year), TIPs and a ton of intermediate-term Treasury notes (original maturity of 2 to 10 years). What happens when these securities mature? The federal government makes the final payment to the Fed, the Fed deducts a small administrative fee, then returns the rest to the U.S. Treasury. Thanks to Modern Monetary Theory (and the university professors who dreamed it up), we really can have it all.

Now let's look at the term structure of federal debt; in other words, when does all of this debt come due? Generally, shorter-term debt has a lower interest rate than longer term debt. So if you want to spend as much as possible and minimize your current interest expense, what kind of debt do you issue? That's right, short-term debt. This is exactly what got Bear Stearns and the Greek government in trouble. Because as soon as interest rates rise (and in the last year, they've risen about as fast as they ever have), you have to roll over maturing debt at ever-higher interest rates, which continually and dramatically increases your current interest expense, which means you have to borrow more to service the debt. But the higher interest burden and larger amount of debt increases the risk of loaning to you (especially when you have the power to debase the currency), which causes interest rates to rise even higher. It's a doom loop.

Who were the geniuses that came up with this great idea of financing long-term liabilities with short-term debt? While researching this issue, I found this smoking gun from the Brookings Institute, a liberal think tank: “The authors suggest that issuing debt at intermediate maturities – particularly two-, three-, and five-year securities – is appealing, as those securities do not involve high expected costs and yet are effective at smoothing variation of interest expenses over time. Issuing too much on the long end – 10 years and beyond – is particularly unattractive, as this increases debt service costs without reducing variability. However, the exact optimal maturity profile depends on the risk aversion of the issuer. A risk neutral or moderately risk averse debt manager would prefer to skew issuance towards the short end, producing a larger concentration of debt with maturities of five years or less than observed in the current U.S. Treasury debt stock; while a highly risk averse debt manager would choose to issue fewer short-term and more long-term securities.” (emphasis added)

Scroll down to the first chart on this page and click the play button beneath it, which will show you how the term structure of federal debt has changed since 1953. Note how the percentage of Treasury notes and bonds (the two bars on the far right) have changed since 2002. More of the debt is in shorter-term notes, which greatly increases reinvestment risk (i.e., the risk that a borrower will have to refinance when prevailing interest rates are high). A far more granular view of this is the chart at the bottom of page 3. Treasuries have become the Mother of All Adjustable Rate Loans.

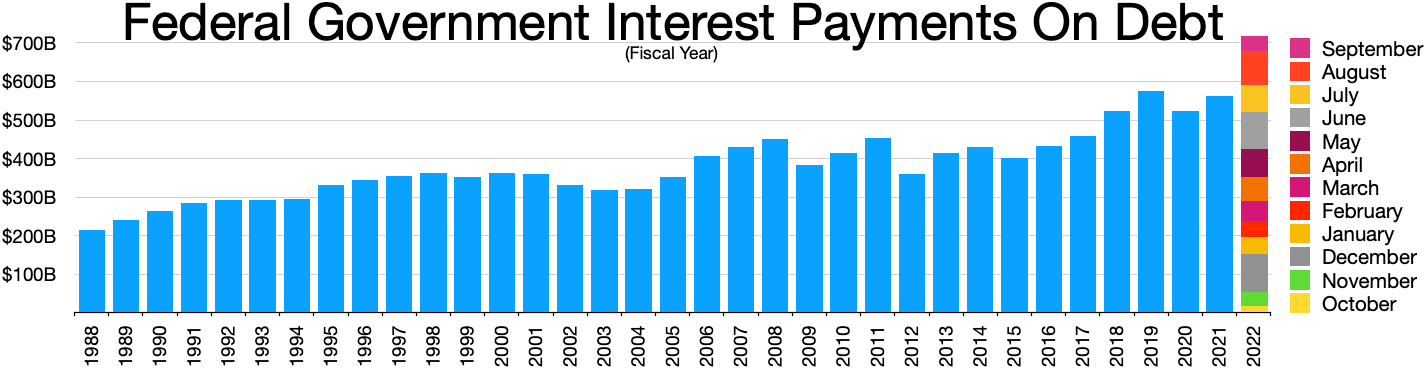

Now let's take a closer look at how rising rates will increase interest payments. The next chart shows federal interest payments going back to 1988. 2022 saw a large increase from the year before, but interest will probably exceed $1 trillion this year.

Here's a longer term chart that goes back to 1947, which allows you to see how we are in unchartered territory.

This chart goes back to 1950. Does this look sustainable?

Speaking of sustainability, check out the two charts on page 5. Public debt divided by the labor force and wages has exploded since the 1970s. Now do you understand why Gen X feels like a beast of burden, a rented mule? Not only do we find ourselves under the yoke of this crushing debt that was piled on us by Baby Boomer voters and politicians, we won't receive the federal benefits that have been promised to us. Do you understand why so many working age people have checked out of the labor force since 2000? Why bother? You can't fight that tidal wave of debt.

Here's what the future looks like, if things go according to plan (and not worse):

Here's a detailed view of what will drive spending in the future. Note how Major Health Programs and Net Interest (to the extent that the latter can even be accurately projected since interest rates will vary) are projected to consume much more of the federal budget. So there won't be any death panels, right?

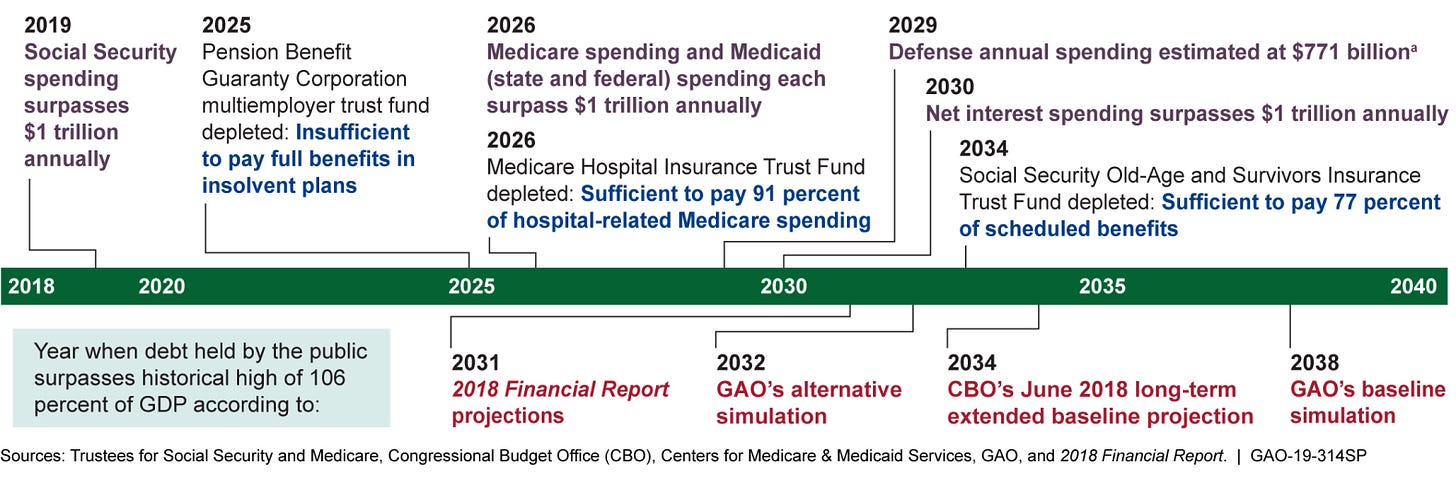

The timeline below shows a preview of coming attractions. The Pension Benefit Guaranty Corporation (which backstops corporate pension plans) is expected to run out of money by 2025. Most such plans today are underfunded, some significantly so. Even if your plan is fully funded and remains so, Stakeholder Capitalism and hyperinflation will destroy it.

By 2026, Medicare and Medicaid spending will both surpass $1 trillion per year, but Medicare will be able to pay only 91% of its bills. But at least Americans will be healthy as a result, right?

Forget about interest expense of over $1 trillion by 2030 because that will probably happen this year, seven years early.

By 2034, Social Security will have enough money to pay for 77% of promised benefits, if all goes according to plan.

But wait, it gets better. Why do you think bank stocks are tanking right now? A hint is at the top of page 13. I predicted this over 100 issues ago, back in Issue #34, after reading Michael Pento's book The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market. Here's an extended quote from that issue, with my emphasis in bold:

For me, the most insightful part of the book was the few pages where he discusses the Basel banking regulations:

“Basel is an international standard for banking regulators to control how much capital banks need to put aside to guard against the types of financial and operational risks banks face....But as we witness throughout history, regulations not only fail in solving the problem, they too often channel the Fed and the banking systems' excess money creation into favored asset classes, creating a repository for bubbles.

“Basel II encouraged banks to amass collateralized debt obligations (CDOs) and mortgage-backed securities (MBSs) by allowing them to meet reserve requirements utilizing these high-yielding debt instruments. It permitted the outsourcing of financial risk management to credit rating agencies who, enticed by fees, liberally provided AAA ratings. This led AAA ratings to be donned on MBSs and credit default swaps that, in the end, proved to be extremely bad credit risks.

“Now they have concocted Basel III, which...acts as an enormous incentive for banks to purchase and hold sovereign debt [such as U.S. Treasuries]....And when the bubble in sovereign debt explodes in their faces, they will reconvene and formulate Basel IV.” This reminds me of the Maginot Line that France built after WWI along its border with Germany to prepare for the next war, which was rendered obsolete by Germany's blitzkrieg.

“...Basel III allows banks to purchase sovereign debt without any reserve requirements. In essence, banks have been greatly incentivized to purchase unlimited amounts of Treasuries instead of making 'more risky' loans to the private sector. This has managed to hold the collapse of the bond bubble in abeyance. However, it has also at the same time vastly exacerbated the problem by encouraging yet more monetization of the bubble from private banks. Basel III increases the amount that the banks have to hold in reserves and greatly favors U.S. Treasuries as an asset class.”

Can you guess how this movie will end? And because banks around the world are loaded to the gills with “safe” sovereign debt, it won't be just a fiscal crisis for the federal government, it will be a global collapse of banks (and their depositors), sovereign debt, fiat currencies, governments, trade, the supply chain and economies (remember that many large corporations rely heavily on the commercial paper market to fund their daily operations). It will be the greatest financial collapse in world history.

Remember the Greek debt and banking crisis that started in late 2009? Do you remember the cause? Too much government debt, and banks that were stuffed to the gills with it. Guess what? That's the exact same situation we have in the U.S. right now. (BTW, Goldman Sachs engineered the financial alchemy that allowed the Greek government to hide its debt, and I'm sure it continued to “do God's work” by doing the same in the U.S.) So get ready for limits on bank withdrawals, a bank holiday, bank bail-ins, a central bank digital currency, a debt jubilee and the rest of The Great Reset.

News You Can Use

Existing Home Sales Suffer Second Weakest Summer Ever

Interest Payments on Student Loans to Resume Oct. 1

China Makes Mass Arrests at Evergrande

Recommended Books (I receive a commission if you buy a book via this link.)

I would love to hear from you! If you have any comments, suggestions, insight/wisdom, or you'd like to share a great article, please leave a comment.

Disclaimer

The content of this newsletter is intended to be and should be used for informational/ educational purposes only. You should not assume that it is accurate or that following my recommendations will produce a positive result for you. You should either do your own research and analysis, or hire a qualified professional who is aware of the facts and circumstances of your individual situation.

Financial Preparedness LLC is not a registered investment advisor. I am not an attorney, accountant, doctor, nutritionist or psychologist. I am not YOUR financial planner or investment advisor, and you are not my client.

Investments carry risk, are not guaranteed, and do fluctuate in value, and you can lose your entire investment. Past performance is not indicative of future performance. You should not invest in something you don't understand, or put all of your eggs in one basket.

Before starting a new diet or exercise regimen, you should consult with a doctor, nutritionist, dietician, or personal trainer.

Great article, I’ve seen this coming for some time. I will pass on all future vaccines