Issue #158

For years now I've been thinking about how demographics will affect the supply and demand for securities (especially U.S. stocks) in the future. It's not a pretty picture.

From the 1980s to the present, the savings of Baby Boomers (born between 1946 and 1964) helped drive U.S. stocks higher. Unlike today, they could afford to save significantly more because living expenses were manageable (the cost of houses, cars, health insurance, health care and higher education hadn't yet gone through the roof), taxes and regulations were fairly low, and generally aging parents weren't a burden.

As Boomers entered retirement, Social Security provided an additional source of income and Medicare paid for most of their health care. Fully funded pension plans provided yet another source of income for many of them; government pensions have been especially lucrative. In recent decades, Boomer spending—much of it paid for by debt-financed government benefits—has created demand for U.S. goods and services, resulting in jobs for younger Americans and profits for their companies.

Unfortunately, this largely debt-fueled party will soon be over. The oldest Boomers are now 78, and are dying at an increasing rate. Many will leave behind a substantial inheritance to their family or charity. Boomers own 56% of stocks, worth over $20 trillion, and retirees own more of the U.S. stock market than ever before. What will happen to these inherited stocks?

Well, charities will sell them, as they're in the business of raising and spending money, not managing an investment portfolio. Many Gen Xer heirs will continue to invest much of what they inherit, using the principal and income to help pay for increasingly exorbitant expenses. Millennials and Gen Z will generally sell the vast majority of it to pay off $1.77 trillion of student loans, $1.129 trillion of credit card debt (90+ day delinquencies are soaring among cardholders younger than 40 to 9-10% of balances), buy a (very expensive) car, make a down payment on a house, or buy tickets to a Taylor Swift concert.

As an investment advisor, I have seen virtually no interest in investing from these younger generations, for a number of reasons. First, they have seen Boomers and Gen Xers suffer through several traumatic busts and are wary of financial markets. As a result, many of them don't know anything about investing; you fear what you don't know. Second, Millennials and Gen Z seem to have an extreme time preference for the present and generally do not wish to delay gratification. Further, most of them are leftists and so are hostile to capital, wealth and free markets. They're more concerned with buying credits to offset their carbon footprint than they are in buying dividend-paying stocks.

As Boomers get older and their time horizon shortens, many will want to reduce their risk by selling stocks and buying bonds and CDs (which now carry a much higher interest rate than they did for many years). And if the U.S. stock market crashes (which I think could happen at any time), most of them will want to sell much of their stocks, as they won't have enough time to recover from a bear market (which in the past have lasted for as long as 20 years). The selling could create a self-reinforcing loop, especially since so much money is in index funds today. (BTW, currently 28% of the S&P 500 index is in the Magnificent 7 stocks.) The more the stock market declines, the more Boomers will want to sell, because they can't afford to lose 85% of their portfolio.

So who will buy these stocks that are sold as Boomers age, when Boomers sell during a crash (especially since the primary reason U.S. stocks will crash is that they have become de facto social justice nonprofits), or after they die? Generally, not Millennials or Gen Z, for the reasons listed above. Additionally, all of the younger generations will be saddled by the high debt, taxes and interest rates left behind by the Boomers' debt-fueled spending binge.

How about foreign investors and sovereign wealth funds? In recent years, most of the world has become increasingly fed up with the U.S. and its Exorbitant Privilege (i.e., the ability to pay for foreign goods by printing dollars) and its meddling in other countries by the State Department, the U.S. military, the CIA and the World Bank.

Since about half of all U.S. dollars are outside of the U.S., the world already has too much exposure to it, and in recent years have been taking steps to reduce their exposure by reducing their holdings of U.S. Treasuries, by using other currencies for international trade, and by developing a BRICs-based currency. With the U.S. dollar at risk or losing significant value relative to other currencies, it wouldn't make sense for foreign investors to buy a lot of U.S. stocks since their proceeds from the sale of those stocks would buy less of their own currency (i.e., they would experience a currency loss).

Additionally, after the U.S. kicked Russia off the SWIFT payment system following its invasion of Ukraine, the rest of the world is wary of suffering the same fate for not toeing the U.S. line, and is making other plans so it can continue to conduct business even if it falls afoul of Washington.

How about wealthy Americans? The wealthiest 10% own 88.6% of stocks, and the wealthiest 1% owns 53%, so the wealthy are already stuffed to the gills with equities and I think are unlikely to buy a lot more, especially at current valuations. Also, as governments' (federal, state and local) fiscal condition becomes increasingly desperate, and as more younger, socialist-minded people begin to vote, I predict there will be a war on the wealthy (which would cause stocks to plunge perhaps like nothing else).

Note how since 2001, the top 1% have been getting wealthier while those in the bottom 90% (many of whom are now Trump supporters) have been getting poorer. This is not healthy, and will cause trouble in the future.

How about new investors? As of last year, 61% of Americans owned stocks, the highest level since the Great Financial Crisis of 2008, and more than during the 2000 Dot Com bubble. Is that a trend or a sign of a top? Hmm, I'm going to go with the latter, especially when you consider younger generations' affinity for socialism and society's increasing appetite for free stuff.

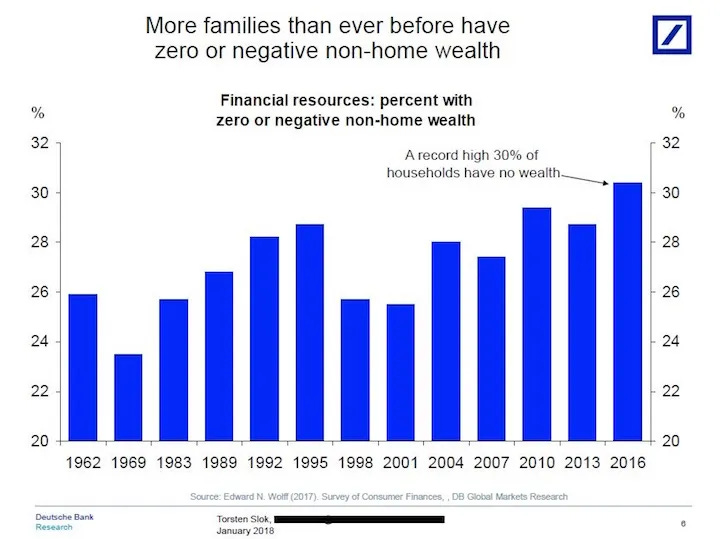

How about poorer people? Nope, see the following chart:

Here's something else you probably haven't thought of: The SECURE Act reduced the period over which non-spouse beneficiaries of qualified retirement plans and IRAs could take distributions, from the beneficiary's remaining life expectancy to just 10 years (which will probably occur during the beneficiary's peak earning years, significantly increasing their income tax burden). Distributions from these plans must be made in cash, so stocks will need to be sold to fund them. I'm guessing that not all of the distributions will be recycled back into stocks in a taxable account. Instead, much of it will be used to pay for income taxes, health insurance and health care, elder care, car-related expenses, higher education, and the rapidly increasing costs of everyday living.

Sure, there's always the possibility that we could descend further into Clown World, with the Fed buying equities like Japan's central bank has done and China's may do soon. But they would have to do that with printed currency, so the real value of shares probably wouldn't change much. And if central banks take a stake in companies, they'll become more like the state-owned enterprises that are currently threatening to collapse China's financial system, so you wouldn't want to own stocks anyway.

In conclusion, the supply/demand outlook for U.S. stocks seems grim. The silver lining is that due to the widespread use of index funds, the baby will get thrown out with the bathwater, and good companies will be available at bargain basement prices. The worst financial and economic crisis in human history will leave investors shellshocked and despondent, creating an unbelievable once-in-a-lifetime opportunity for patient, contrarian investors who have plenty of cash and the courage to buy at the point of maximum pessimism.

News You Can Use

Financial Big Brother Is Watching You

Recommended

Dumb Money NB: This docudrama on Netflix is by far the raunchiest movie I've ever seen. But it's a good reminder that these days, the stock market is rigged (just like everything else).

Recommended Books (I receive a commission if you buy a book via this link.)

I would love to hear from you! If you have any comments, suggestions, insight/wisdom, or you'd like to share a great article, please leave a comment.

Disclaimer

The content of this newsletter is intended to be and should be used for informational/ educational purposes only. You should not assume that it is accurate or that following my recommendations will produce a positive result for you. You should either do your own research and analysis, or hire a qualified professional who is aware of the facts and circumstances of your individual situation.

Financial Preparedness LLC is not a registered investment advisor. I am not an attorney, accountant, doctor, nutritionist or psychologist. I am not YOUR financial planner or investment advisor, and you are not my client.

Investments carry risk, are not guaranteed, and do fluctuate in value, and you can lose your entire investment. Past performance is not indicative of future performance. You should not invest in something you don't understand, or put all of your eggs in one basket.

Before starting a new diet or exercise regimen, you should consult with a doctor, nutritionist, dietician, or personal trainer.

The current deficit and market to the moon scares the hell out of me. Nvidia is priced for perfection over the next 10 years using reverse DCF principles. Time to buy ? Nah