Issue #110

After the second and third largest U.S. bank failures in modern history this week, I've been fielding questions from clients who are concerned about the safety of the U.S. banking system. They should be concerned. For many years now, I've been saying that the next financial crisis will be not only the worst in our lifetime, but the worst in human history. Here's why.

First, the banking system is a complex system, which is just one part of the larger financial system. If you're an investor or even just someone who wants to survive with access to the basic necessities, it is absolutely imperative that you know about complex systems and how they work. Complex systems are one of the primary reasons I started this newsletter, which is why I wrote about them in Issue #2.

Complex systems are not in Normalstan, but Extremistan. They have emergent properties, which are results that cannot be predicted in advance. If you could run a complex system through say a thousand periods of time and then plot the results, it would not produce a normal (Gaussian) bell-shaped curve. Instead, it would have “fat tails” (a surprising number of extreme results on the far left and right sides of the curve). These extreme results cause history to leap.

Learning about complex systems is like taking the Red Pill, because you realize that instead of being in a safe and comfortable world where all of your needs are met, you're really standing on the edge of a precipice, staring down into the abyss, and the ground you're standing on could collapse at any time.

Never before has humanity been surrounded by so many complex systems (e.g., financial markets, politics, war, supply chains, etc.). Not only can any of these collapse at any time, but if/when it does collapse, it could cause other complex systems to collapse as well.

The problem with complex systems is that as they increase in size, even if only at a linear rate, the amount of energy required to keep the system from collapsing increases exponentially. Therefore, if complex systems continue to increase in size (like our banking system), they will eventually collapse. Money is one form of energy. As you can see from the chart below, after increasing rapidly during COVID, the money supply is now contracting for the first time ever. The system is collapsing because it has run out of energy.

Collapse happens gradually, then suddenly (40-year old Silicon Valley Bank collapsed in just 44 hours). In the U.S. the “gradually” part has been happening since at least 2008. Politicians and central bankers have tried to keep the confidence game going by adopting a policy of Kick the Can Down the Road. Their solution to too much spending, debt, leverage, currency printing, bailouts and moral hazard is more of the same. Now they cannot kick the can any more because there is no more road.

The Fed's central planning has been as disastrous as that of the central planners under communist regimes. A modern economy is vastly more complex and nuanced than a committee of academics (most of whom have little real world experience, many of whom don't even understand how economics works, and none of whom have any skin in the game) could ever hope to understand. And of course since they are nominated by the big banks and appointed by the president, they could have conflicts of interest, may be susceptible to corruption, or be influenced by political pressure (including their own political views).

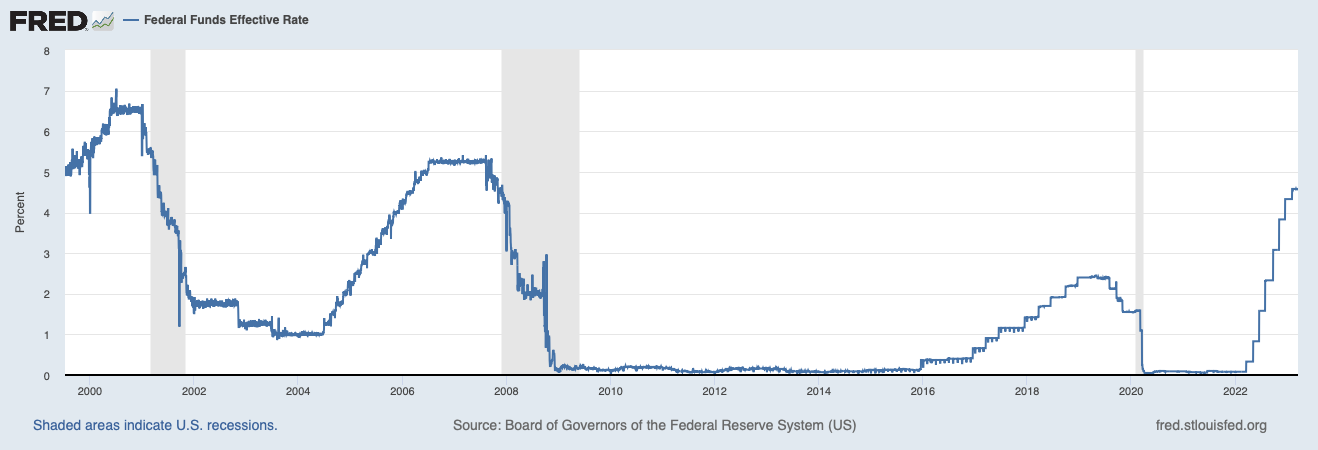

The Fed's policies magnify and exacerbate the normal business cycle into a Boom-Bust cycle. During the Dot Com bust, the Fed slashed the Federal Funds Rate from about 6.5% to 1%, which in turn fueled the housing boom. During the housing bust and Great Financial Crisis of 2008, the Fed slashed rates from about 5.25% to nearly 0%, and kept them pinned to the mat until 2015. During COVID, it again slashed rates from about 2.5% to nearly 0%. Then at the beginning of 2022, for whatever reason (perhaps to make the dollar more attractive than foreign currencies and cryptocurrencies), it began a historically steep series of interest rate increases.

Low interest rates reduce the cost of capital. When interest rates are kept artificially low for an extended period of time (as they have been since 2008), it makes a lot of ventures that would normally be unprofitable (such as tech startups, cryptocurrencies, green energy projects, ESG investments, NFTs, SPACs, pot farms, etc.) profitable. When interest rates rise rapidly, suddenly the owners of these investments have large unrealized losses.

That was the primary problem of Silicon Valley Bank (SVB) and Signature Bank. SVB had a lot of exposure to the (now contracting) tech (including cryptocurrency) industry. About half of all venture capital-funded startups in the U.S. were customers of SVB; that's about 65,000. Artificially low interest rates (and thus a lower cost of capital) made many of these startups appear to be profitable investments. Somehow, it never occurred to anyone at SVB that if there are about 130,000 venture capital-funded startups in the U.S. (probably most of which are in one industry), it has probably reached the point of saturation, and therefore abnormal profit opportunities are unlikely.

SVB attracted a lot of deposits (apparently much of which were from employees at tech companies who were flush with cash from venture capital or stock options) by paying high interest rates. How could it pay high interest rates? Primarily by making riskier, high-interest and longer term loans, including to many of these same tech companies and startups.

But wouldn't those riskier loans make depositors worry about getting their money back? Naw, man, it's all good! You see, the FDIC insures deposits up to $250,000 per account. (All banks have to contribute to the FDIC's insurance fund, so the customers of banks that lend prudently subsidize the customers of banks that lend more speculatively.) So this federal policy of insuring bank deposits encourages banks to take excessive risks and their customers to not care about how their bank is investing their money. So instead of wary bank customers, prudent banks and rare, small failures and losses, we get catastrophic failures and losses that could cause the entire banking and financial system to collapse.

By the way, the FDIC's insurance fund is nowhere near large enough to insure depositors in the event of a systemic banking crisis or collapse. In that case, the Fed/Treasury would probably just print trillions of dollars and drop it from helicopters. Prices would immediately skyrocket, and many investors and households would be wiped out.

One of the actions taken by the Treasury/Fed/FDIC last weekend (you know the situation is bad when these people are working all weekend) was to remove the $250,000 cap on deposits that are insured by the FDIC, but for only those two banks. Why? Well, about 90% of deposits at these banks were uninsured because they exceeded $250,000. Who has far more than $250,000 in bank accounts? Generally smart, wealthy people who should have known better. In this case, people who worked or invested in the tech industry. As former FDIC chair Sheila Bair wrote this week, “The uninsured depositors of SVB are not a needy group. They are a ‘who’s who’ of leading venture capitalists and their portfolio companies. Financially sophisticated, they apparently missed those prominent disclosures on the bank’s websites and teller windows that FDIC insurance is capped at $250,000.”

If/when the Farmers Bank of Arkansas fails as part of a systemic banking collapse, you can bet that Joe the plumber will not get bailed out, he will get bailed-in. So this was a bailout of the tech industry. Why? Well, Big Tech and the federal government have a symbiotic relationship. Big Tech performs the spying, censoring, propaganda and election-rigging functions that the government either can't legally do or would rather not get involved with. The vast majority of its employees are woke and make large donations to statist politicians and organizations.

Additionally, I'm sure that many of the customers of these two banks were either clean energy companies (or similar ones that are needed for The Great Reset) or their employees. SVB was a darling of ESG investors, and gave $70,650,000 to the Black Lives Matter movement and related causes (Signature Bank gave $850,000).

And speaking of governance (the G in ESG stands for governance), two of SVB's directors were former senior executives at major accounting firms, and a third was a former official in Obama's Treasury Department, where she “was responsible for developing and coordinating Treasury's policies and guidance in the areas of financial institutions... financial regulation, and capital markets. Her role included oversight of the Financial Stability Oversight Council." The best part, though, is that the accounting firm KPMG had just signed off on the financial statements of both banks. Oops!

Signature Bank's recent history is interesting. Ivanka Trump served on its board from 2011-2013, but following the Jan. 6, 2021 riot on Capitol Hill, it closed President Trump's accounts and asked him to resign. Former Congressman Barney Frank (D, MA) has been on the bank's board for nearly eight years. Wow, financial catastrophe follows this guy wherever he goes. As the Rational Walk Substack writes, “There is something grotesque about politicians retiring from 'public service' and landing at corporations in the industries that they regulated and then extracting millions of dollars in compensation for what is, at best, a very part time job. Anyone with an ounce of common sense sees that this stinks to high heaven. If current politicians and regulators see former politicians and regulators rewarded in this manner, they will get a clear message from the private sector: 'Let’s be friends while you are in public service and we will take care of you once you retire'.” Here's another board member with an interesting financial history.

Six months before its collapse, Signature hosted a seminar on gender pronouns. Apparently they did not cover how to pronounce “i-n-s-o-l-v-e-n-t” or “c-o-l-l-a-p-s-e.” And here's a fun virtue-signaling video they made. Kumbaya!

Here's an example of why an investor needs to be a contrarian: “Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list.”

In conclusion, the banking system is a house of cards that could collapse at any time due to excessive size, leverage and moral hazard, poor corporate governance, political mandates, misplaced priorities (ESG and DEI instead of profitability), hidden off-balance sheet liabilities, bad loans, massive exposure to derivatives and sovereign debt, contagion, and captured regulatory agencies. That's why my clients and I have not invested in bank-related securities since 2009.

News Items

Here’s What the Latest Bank Bailout Does, and Why the Treasury Is Quietly Freaking Out

Banks: The Elephant Nobody Even Sees

The Growing Auto Loan Problem Facing Young Americans

I would love to hear from you! If you have any comments, suggestions, insight/wisdom, or you'd like to share a great article, please leave a comment.

Disclaimer

The content of this newsletter is intended to be and should be used for informational/ educational purposes only. You should not assume that it is accurate or that following my recommendations will produce a positive result for you. You should either do your own research and analysis, or hire a qualified professional who is aware of the facts and circumstances of your individual situation.

Financial Preparedness LLC is not a registered investment advisor. I am not an attorney, accountant, doctor, nutritionist or psychologist. I am not YOUR financial planner or investment advisor, and you are not my client.

Investments carry risk, are not guaranteed, and do fluctuate in value, and you can lose your entire investment. Past performance is not indicative of future performance. You should not invest in something you don't understand, or put all of your eggs in one basket.

Before starting a new diet or exercise regimen, you should consult with a doctor, nutritionist, dietician, or personal trainer.

Great read!